About Michael

Michael is an industry veteran whose efforts for clients now spans more than 25 years. He has effectively navigated through vast swings in market conditions to help clients pursue their goals.

Michael is the founder of Innovative Financial Solutions, Inc. which is now partnered with WealthCare Advisory Partners. This combination brings together deep experience across financial markets and instruments with leading-edge financial technologies.

Michael is a Certified Financial Planner™ Professional, a Chartered Financial Consultant and an Enrolled Agent as designated by the Department of Treasury. In addition, he is a licensed LPL Financial Registered Representative and maintains Life, Health, Annuity, Property and Casualty insurance licenses in Florida as well as other states. Michael is a graduate of Florida State University with a Bachelor of Science in the field of Economics.

Michael enjoys traveling with his wife Shera and three sons Andrew, Austin and Max.

HOW WE STRIVE TO SUCCEED

- We start with a discovery meeting (which is free) to discuss your current financial situation and your financial goals. This affords us both the opportunity to determine if we are a good fit and if we will work well together.

- We personalize our approach to your financial independence based on building a deep understanding of what drives you, your risk profile, and your financial goals. We align your investments with your personal goals.

- We combine deep experience across financial markets and instruments with leading-edge financial technologies.

- We are watchful and we flex, adjusting to changing market conditions or changes in your financial goals.

- We maintain fluid communication, meeting both in person (at our office or at your home if circumstances require) and through online conference (using teleconference and screen sharing). We make sure you know where you stand, presenting your progress reports in “plain” English.

- We assure transparency so that you understand our engagement process. For Project Planning, we work on an hourly basis. For Financial Plans and ongoing planning needs, we work on a flat fee/retainer basis. For Investment Management, we work on either a flat commission or a percentage fee.

Why Wealthcare?

Established in 1999, Wealthcare Capital Management (Wealthcare) is a very different kind of a financial advisory firm. We pioneered a new way of providing financial life guidance, using Goals-Based Wealth Management. The cornerstone of our patented goals-based investing process is quite simply to help our clients, above all else, to make the most of their life.

We accomplish this by helping you understand and identify your most important life goals. And then we align your investments with those goals. Our process guides you through the myriad of changes in your life that will invariably require financial decisions. This is what we refer to as Financial Guidance for Life.

At Wealthcare, we measure our success in our clients’ fulfillment — one client at a time.

With our goals-driven investing approach, you will:

- Have your personal goals in complete alignment with your investments.

- Always know where you stand and we’ll present your progress reports in “plain” English.

- Have confidence in your ability to reach your goals, independent of market fluctuations and changing life circumstances.

Our Process

Wealthcare’s patented process is designed to help you reach your life goals, while minimizing unnecessary investment risk or needlessly sacrificing your life now.

Our process is dynamic and continual, as is life, and it will guide you through the entirety of your financial life.

MOST IMPORTANTLY, THE WEALTHCARE PROCESS IS YOU- DRIVEN. NOT MARKET DRIVEN. IT’S POWERFULLY SIMPLE. IT’S REFRESHINGLY CLEAR.

And it all STARTS WITH A GREAT CONVERSATION

A conversation that helps you to visualize your most important life goals

Dream Big

Do you like to travel? How will you pay for your children’s education? What exactly does “comfortable” retirement look like to you? You’ll cover these topics — and more — during our initial conversation.

We’ll use this conversation as a launching pad for creating your financial life plan. My objective as your Wealthcare advisor is to inspire and guide you toward pursuing the life of your dreams. I will help you define your life goals, and most importantly, will guide you toward achieving them.

But this is just a beginning. Wealthcare’s financial plan is not a “set it and forget it” tool. It’s a dynamic financial guidance system that evolves as your circumstances and financial markets change. I will continually monitor your plan against your changing life events and your investment portfolio, keeping the two in sync. Our software runs sophisticated market simulations, designed to monitor, measure and track your progress and report back to you with clarity.

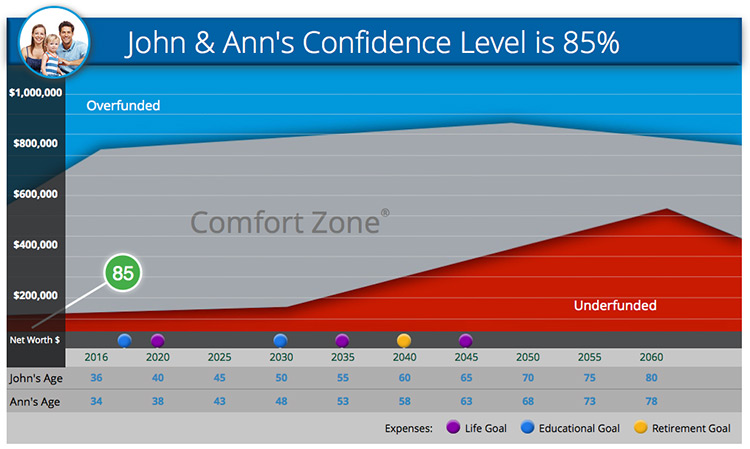

Your Comfort Zone®

You will have confidence in your financial life plan because I will be constantly performing analytics in an effort to ensure your success. At Wealthcare, we call this being in the Comfort Zone. The Comfort Zone measures the probability of reaching your financial goals. And it also alerts you if you veer off course.

John & Ann's Confidence Level is 85%

Overfunded

Comfort Zone®

Underfunded

Click on a goal to see more

This chart is for illustrative purposes only.

Stay on Course

The Wealthcare process is YOU-driven, not market-driven. As your circumstances, goals and priorities change, I will work with you to make appropriate adjustments. Whatever life events come your way — from expanding your family to buying a vacation home — I will monitor and measure each event against its financial impact on your plan.