About the Wealthcare Advisory Partners team

Christopher Becks, Advisor

Christopher (Chris) specializes in personal financial planning for business owners and healthcare professionals, as well as retirement plan consulting for 401(k) plans. He relies on perseverance and a strategic mindset to help his clients plan for the future, manage risks and track their progress toward their goals, including a comfortable retirement.

He earned a bachelor’s degree in business from Drake University in Iowa and served as a Captain in the United States Marine Corps. He has earned the Accredited Investment Fiduciary™ (or AIF®) designation from the Center for Fiduciary Studies and is recognized as a professional plan consultant (PPC). He also is involved in the International Association of Registered Financial Consultants and has served on the editorial advisory board of the Journal of Personal Finance.

He has been quoted on Forbes.com, the SE Wealth Management Journal, and the Seminole County Women’s Newspaper. Chris’ passion for planning services started young. His father owned a financial planning firm in St. Louis, Missouri, but Chris decided to trade cold northern weather for the Florida sun and lives in the Central Florida area. His other passions in life are spending time with his two sons, Jake and Alec, surfing and working on his 1978 Chevy truck.

Olivia Allen, Administrative Assistant

Olivia Allen, Administrative Assistant

Olivia (she/her) joined Wealthcare after having spent the beginning of her career as a financial advisor herself, during which time she earned her Series 7, 66, and life and health insurance licenses. Since switching roles, she has found her experience in the advisor seat provides a unique perspective that allows her to be proactive for her advisors, able to hit the ground running with her embedded understanding of fintech, paperwork/processes, and overall organization required to run an optimal practice.

Raised in Princeton, New Jersey, Olivia previously called Wilmington, North Carolina and Steamboat Springs, Colorado home. She currently resides in her partner’s home state of Arkansas where she is quickly learning to appreciate college athletics. She travels frequently, most recently to fish in beautiful Seward, Alaska. When not in her home office, Olivia can be found in a yoga studio, wake surfing in a nearby lake, or hiking with her dog, Jackson.

Why Wealthcare?

Established in 1999, Wealthcare Capital Management (Wealthcare) is a very different kind of a financial advisory firm. We pioneered a new way of providing financial life guidance, using Goals-Based Wealth Management. The cornerstone of our patented goals-based investing process is quite simply to help our clients, above all else, to make the most of their life.

We accomplish this by helping you understand and identify your most important life goals. And then we align your investments with those goals. Our process guides you through the myriad of changes in your life that will invariably require financial decisions. This is what we refer to as Financial Guidance for Life.

At Wealthcare, we measure our success in our clients’ fulfillment — one client at a time.

With our goals-driven investing approach, you will:

- Have your personal goals in complete alignment with your investments.

- Always know where you stand and we’ll present your progress reports in “plain” English.

- Have confidence in your ability to reach your goals, independent of market fluctuations and changing life circumstances.

Our Process

Wealthcare’s patented process is designed to help you reach your life goals, while minimizing unnecessary investment risk or needlessly sacrificing your life now.

Our process is dynamic and continual, as is life, and it will guide you through the entirety of your financial life.

MOST IMPORTANTLY, THE WEALTHCARE PROCESS IS YOU- DRIVEN. NOT MARKET DRIVEN. IT’S POWERFULLY SIMPLE. IT’S REFRESHINGLY CLEAR.

And it all STARTS WITH A GREAT CONVERSATION

A conversation that helps you to visualize your most important life goals

Dream Big

Do you like to travel? How will you pay for your children’s education? What exactly does “comfortable” retirement look like to you? You’ll cover these topics — and more — during our initial conversation.

We’ll use this conversation as a launching pad for creating your financial life plan. My objective as your Wealthcare advisor is to inspire and guide you toward pursuing the life of your dreams. I will help you define your life goals, and most importantly, will guide you toward achieving them.

But this is just a beginning. Wealthcare’s financial plan is not a “set it and forget it” tool. It’s a dynamic financial guidance system that evolves as your circumstances and financial markets change. I will continually monitor your plan against your changing life events and your investment portfolio, keeping the two in sync. Our software runs sophisticated market simulations, designed to monitor, measure and track your progress and report back to you with clarity.

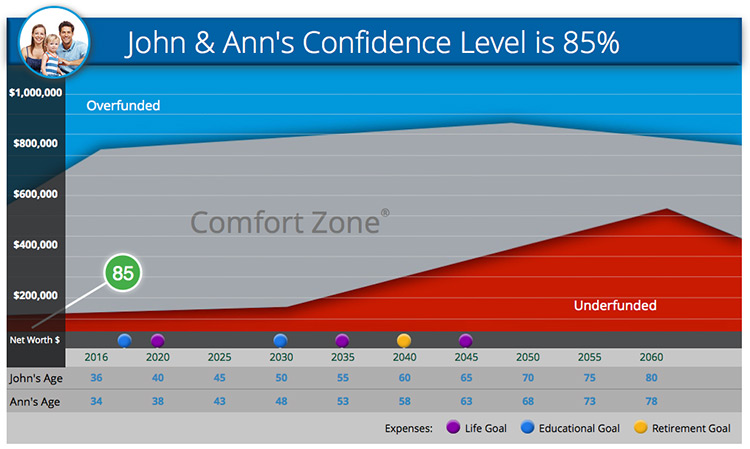

Your Comfort Zone®

You will have confidence in your financial life plan because I will be constantly performing analytics in an effort to ensure your success. At Wealthcare, we call this being in the Comfort Zone. The Comfort Zone measures the probability of reaching your financial goals. And it also alerts you if you veer off course.

John & Ann's Confidence Level is 85%

Overfunded

Comfort Zone®

Underfunded

Click on a goal to see more

This chart is for illustrative purposes only.

Stay on Course

The Wealthcare process is YOU-driven, not market-driven. As your circumstances, goals and priorities change, I will work with you to make appropriate adjustments. Whatever life events come your way — from expanding your family to buying a vacation home — I will monitor and measure each event against its financial impact on your plan.