About Joe

Joe Jimenez, a Startup Advisor, founded R J Colvin & Associates (RJC) in February 2021. As CEO of RJC, Mr. Jimenez has collective experience from key advisory roles in fulfilling his vision to make the Best organizations Better. Joe has advised multi-million dollar companies with clear insight into enhancing operations by recommending solutions based on an analysis of their current conditions. His improvements to hundreds of companies span over 16 years as a U.S. Postal Service (USPS) business solutions expert.

While analyzing and evaluating business operations, Joe recommended capital allocations to optimize profits. This skill-set has driven him into the Investment Advisor role.

Mr. Jimenez’s successes as a Senior Executive at USPS provide unequaled business acumen. Joe, a consistent top performer, was selected to train Northern California new hires in sales and acquisition. With a long record of success as a superior performer, Joe never missed his individual sales goal while sacrificing his time “onboarding” recently hired sales staff. As a Regional Trainer, Joe also explored investment strategies with new employees to maximize their individual Thrift Savings Program.

His sales goal was $15 million in new postal revenue annually. As a Star Performer, Joe led the USPS Pacific Area Political Strike Team. The true reward was not the accolades but the opportunity to advise businesses on enhancing their business models.

Mr. Jimenez transitioned from the U.S. Air Force as a flight instructor and executive officer in 1993. Following flight service, Joe related his military experience to transferable skill sets that would successfully allow him to become a Pharmaceutical Medical Representative. Stuart Pharmaceuticals (now re-branded as AstraZeneca) hired Joe in 1994 to detail cardiovascular and anticancer therapeutics. Joe excelled in new hire training, with his sales territory performing as number 7 in comparison to 120 other medical representatives; at the time, healthcare reform issues placed pressure on the pharmaceutical industry to limit profits. This led to medical representatives with 2 years or less experience being laid off – regardless of sales performance. After his release, Joe began his U.S. Postal Service career.

As USAF Plans, Preparedness, and Protocol Officer, Captain Jimenez briefed/advised and enforced compliance for 12 sub-agencies at Mather AFB under peacetime and contingency (emergency, disaster-preparedness) conditions. Joe’s proven record of oversight with cost-effective recommendations provides the background for success in many career fields and markets.

Mr. Jimenez graduated from Golden Gate University (Sacramento) with a master’s in project and systems management. His undergraduate degree is from San Jose State University (finishing in 4 years while working 32 hours per week at Orchard Supply Hardware). Joe excels in every endeavor. Joe served as a senior navigator, flying over 400 hours in T-37, T-38, T-43, and B-52 aircraft. Joe has been happily married for 39 years and has a loving daughter.

Why Wealthcare?

Established in 1999, Wealthcare Capital Management (Wealthcare) is a very different kind of a financial advisory firm. We pioneered a new way of providing financial life guidance, using Goals-Based Wealth Management. The cornerstone of our patented goals-based investing process is quite simply to help our clients, above all else, to make the most of their life.

We accomplish this by helping you understand and identify your most important life goals. And then we align your investments with those goals. Our process guides you through the myriad of changes in your life that will invariably require financial decisions. This is what we refer to as Financial Guidance for Life.

At Wealthcare, we measure our success in our clients’ fulfillment — one client at a time.

With our goals-driven investing approach, you will:

- Have your personal goals in complete alignment with your investments.

- Always know where you stand and we’ll present your progress reports in “plain” English.

- Have confidence in your ability to reach your goals, independent of market fluctuations and changing life circumstances.

Our Process

Wealthcare’s patented process is designed to help you reach your life goals, while minimizing unnecessary investment risk or needlessly sacrificing your life now.

Our process is dynamic and continual, as is life, and it will guide you through the entirety of your financial life.

MOST IMPORTANTLY, THE WEALTHCARE PROCESS IS YOU- DRIVEN. NOT MARKET DRIVEN. IT’S POWERFULLY SIMPLE. IT’S REFRESHINGLY CLEAR.

And it all STARTS WITH A GREAT CONVERSATION

A conversation that helps you to visualize your most important life goals

Dream Big

Do you like to travel? How will you pay for your children’s education? What exactly does “comfortable” retirement look like to you? You’ll cover these topics — and more — during our initial conversation.

We’ll use this conversation as a launching pad for creating your financial life plan. My objective as your Wealthcare advisor is to inspire and guide you toward pursuing the life of your dreams. I will help you define your life goals, and most importantly, will guide you toward achieving them.

But this is just a beginning. Wealthcare’s financial plan is not a “set it and forget it” tool. It’s a dynamic financial guidance system that evolves as your circumstances and financial markets change. I will continually monitor your plan against your changing life events and your investment portfolio, keeping the two in sync. Our software runs sophisticated market simulations, designed to monitor, measure and track your progress and report back to you with clarity.

Your Comfort Zone®

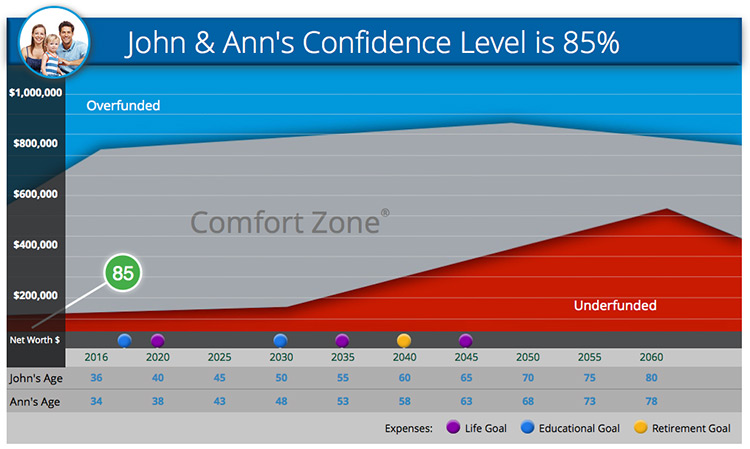

You will have confidence in your financial life plan because I will be constantly performing analytics in an effort to ensure your success. At Wealthcare, we call this being in the Comfort Zone. The Comfort Zone measures the probability of reaching your financial goals. And it also alerts you if you veer off course.

John & Ann's Confidence Level is 85%

Overfunded

Comfort Zone®

Underfunded

Click on a goal to see more

This chart is for illustrative purposes only.

Stay on Course

The Wealthcare process is YOU-driven, not market-driven. As your circumstances, goals and priorities change, I will work with you to make appropriate adjustments. Whatever life events come your way — from expanding your family to buying a vacation home — I will monitor and measure each event against its financial impact on your plan.