About

Charles J. Schilleci, CFP®, RICP®, CKA®

Charles “Charlie” Schilleci is a Managing Partner of Wealthcare Advisory Partners in Knoxville, TN and most recently Birmingham, AL. In 2017, Charlie and Dan Griffey aligned with Wealthcare Advisory Partners to provide clients with a goals-driven experience that seamlessly integrates planning and investing.

With forty years of wealth planning experience, Charlie advises clients who are active and successful professionals, business owners and executives, and includes those who are working, approaching retirement, or retired. Clients turn to him to find clarity about their financial goals and lives by implementing a synchronized process that integrates planning and investments.

By following Wealthcare’s collaborative process, Charlie gives clients what they need most: a competent advisor to guide them in building and monitoring a financial roadmap. He uses Wealthcare’s Comfort Zone® to provide clients with financial independence rooted in the confidence that comes from having a dynamic, actionable plan.

Personal experience shapes Charlie’s views about the value and importance of planning. A medical challenge he faced fourteen years ago is the root of the passion he feels for helping to ensure that clients are prepared for the unexpected. To better serve clients with planning, Charlie earned the CFP® (Certified Financial Planner-1990) and RICP™ (Retirement Income Certified Professional-2014) designations, which evidence long-term commitment to professional development. In addition, as a Christian financial advisor, Charlie also completed the Certified Kingdom Advisor (CKA®-2017) core training program. These experiences, along with his wealth planning knowledge and resources available through the Wealthcare Advisory Partners team, are the cornerstone of Charlie’s holistic approach to planning.

Not one to sit idly, Charlie is an active community participant. He’s a proud member of the Shelby County University of Alabama Alumni Association, and the Logan Martin Red Elephant Club. Charlie also served on the boards of the Pittsburgh and East Tennessee Financial Planning Associations. He is also a member of Vestavia Hills Methodist Church. Among Charlie’s many blessings are his wife Christine, with whom he’s been happily married for 41 years, his three adult children and three grandchildren. Charlie and Christine enjoy golfing, Alabama Football, spending time with the family at the beach and residing now in Birmingham, AL. Roll Tide!

Location:

11826 Kingston Pike

Suite 210

Knoxville, TN 37934

Phone: (865) 392-6201

Daniel Griffey, PPC™

Daniel Griffey is a Managing Partner and Financial Advisor with Wealthcare Advisory Partners LLC in Knoxville, TN. Along with his fellow managing partner, Charlie Schilleci, Dan focused in 2017 on providing clients with a goals-driven experience that seamlessly integrates planning and investing. After a long, successful stretch in outside sales with packaging and paper companies, Dan brought his business savvy and relationship-building experience to the financial services industry. With a background rooted in working with clients to help them achieve their goals, the next logical step was moving to a financial planning and service-focused advisory position. Dan’s passion is working with clients to help them identify and prioritize goals, manage their finances, and model investment strategies, and this passion serves him and his clients well.

Dan advises active and successful professionals, retirees, executives, and business owners in Tennessee and nine other states. Dan and Charlie are a high-touch team that adheres to a common objective: treat every client like family, and promote transparency and efficiency. Dan and the team’s white-glove service model matches the life goals of clients with a suitable investment strategy, regardless of the client’s stage in life or objectives.

By following Wealthcare’s GDX360® process that integrates planning and investing, Dan gives clients what they want most: a steady hand to help them build a financial roadmap and monitor progress toward their life goals. With Wealthcare’s Comfort Zone®, he helps give clients financial independence that comes from the confidence of having an actionable financial plan that adjusts when life changes.

Dan and his wife, Susan, love calling East Tennessee home. They’re thrilled that both of their sons are nearby—Taylor works alongside Dan, while Parker is hitting the books at Lincoln Memorial University’s Medical School.

When he’s not working, you’ll often find Dan out on the golf course at Avalon Country Club, showing off his swing. Growing up on Kentucky Lake in Paris, TN, sparked his lifelong passion for fishing, and it’s still one of his favorite pastimes.

An Eagle Scout and proud Murray State University alum with a degree in business administration and management, Dan is always ready to cheer on the Racers. Go Racers!

Locations:

11826 Kingston Pike

Suite 210

Knoxville, TN 37934

5605 Crossings View

Birmingham, AL 35242

Phone: (865) 392-6202

Why Wealthcare?

Established in 1999, Wealthcare Capital Management (Wealthcare) is a very different kind of a financial advisory firm. We pioneered a new way of providing financial life guidance, using Goals-Based Wealth Management. The cornerstone of our patented goals-based investing process is quite simply to help our clients, above all else, to make the most of their life.

We accomplish this by helping you understand and identify your most important life goals. And then we align your investments with those goals. Our process guides you through the myriad of changes in your life that will invariably require financial decisions. This is what we refer to as Financial Guidance for Life.

At Wealthcare, we measure our success in our clients’ fulfillment — one client at a time.

With our goals-driven investing approach, you will:

- Have your personal goals in complete alignment with your investments.

- Always know where you stand and we’ll present your progress reports in “plain” English.

- Have confidence in your ability to reach your goals, independent of market fluctuations and changing life circumstances.

Our Process

Wealthcare’s patented process is designed to help you reach your life goals, while minimizing unnecessary investment risk or needlessly sacrificing your life now.

Our process is dynamic and continual, as is life, and it will guide you through the entirety of your financial life.

MOST IMPORTANTLY, THE WEALTHCARE PROCESS IS YOU- DRIVEN. NOT MARKET DRIVEN. IT’S POWERFULLY SIMPLE. IT’S REFRESHINGLY CLEAR.

And it all STARTS WITH A GREAT CONVERSATION

A conversation that helps you to visualize your most important life goals

Dream Big

Do you like to travel? How will you pay for your children’s education? What exactly does “comfortable” retirement look like to you? You’ll cover these topics — and more — during our initial conversation.

We’ll use this conversation as a launching pad for creating your financial life plan. My objective as your Wealthcare advisor is to inspire and guide you toward pursuing the life of your dreams. We will help you define your life goals, and most importantly, will guide you toward achieving them.

But this is just a beginning. Wealthcare’s financial plan is not a “set it and forget it” tool. It’s a dynamic financial guidance system that evolves as your circumstances and financial markets change. We will continually monitor your plan against your changing life events and your investment portfolio, keeping the two in sync. Our software runs sophisticated market simulations, designed to monitor, measure and track your progress and report back to you with clarity.

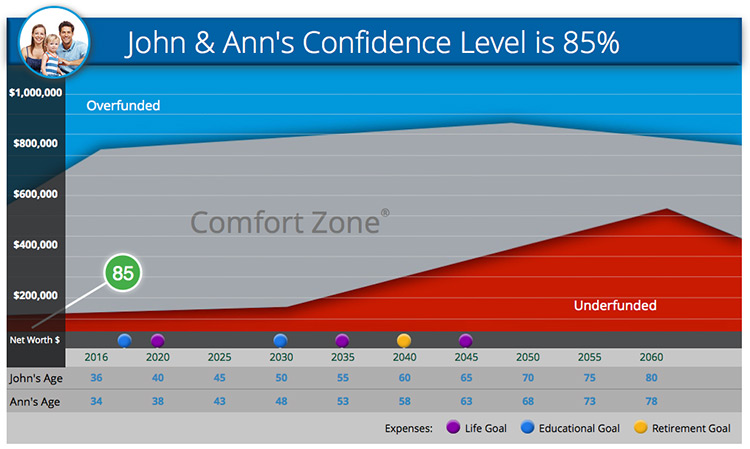

Your Comfort Zone®

You will have confidence in your financial life plan because we will be constantly performing analytics in an effort to ensure your success. At Wealthcare, we call this being in the Comfort Zone. The Comfort Zone measures the probability of reaching your financial goals. And it also alerts you if you veer off course.

John & Ann's Confidence Level is 85%

Overfunded

Comfort Zone®

Underfunded

Click on a goal to see more

This chart is for illustrative purposes only.

Stay on Course

The Wealthcare process is YOU-driven, not market-driven. As your circumstances, goals and priorities change, we will work with you to make appropriate adjustments. Whatever life events come your way — from expanding your family to buying a vacation home — we will monitor and measure each event against its financial impact on your plan.