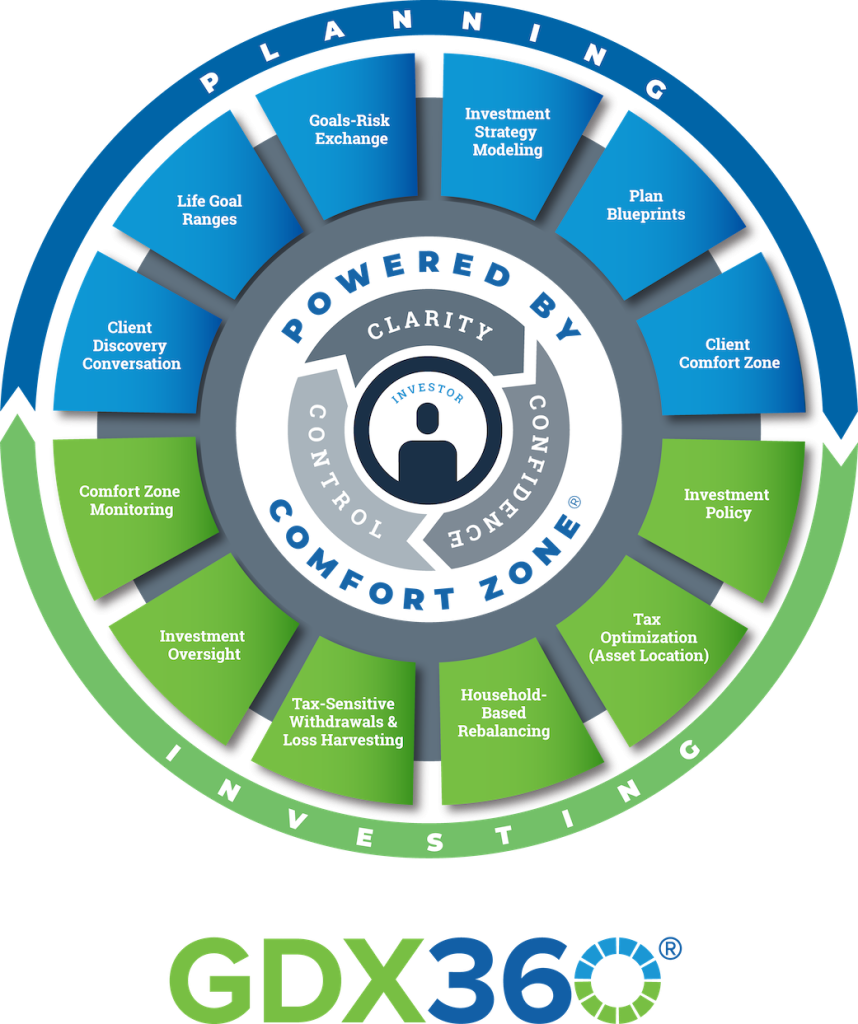

GDX360 synchronizes goals-based planning and investing

Goals-driven advice. Integrated planning and investing. A scalable, efficient advisory business model. And a personalized, innovative client wealth experience.

Get it all with GDX360.

Wealthcare’s GDX360 centers on an innovative and client-friendly process that starts with an open, refreshing conversation. The conversation uncovers what matters most to your advisor’s clients – their life goals. The discussion begins before choosing an appropriate investment strategy.

By connecting life goal planning with investments, Wealthcare can help your advisors put their client’s best interests first.